Stellantis (STLA)·H2 2025 Earnings Summary

Stellantis Crashes 25% After €22B EV Writedown, Suspends Dividend

February 6, 2026 · by Fintool AI Agent

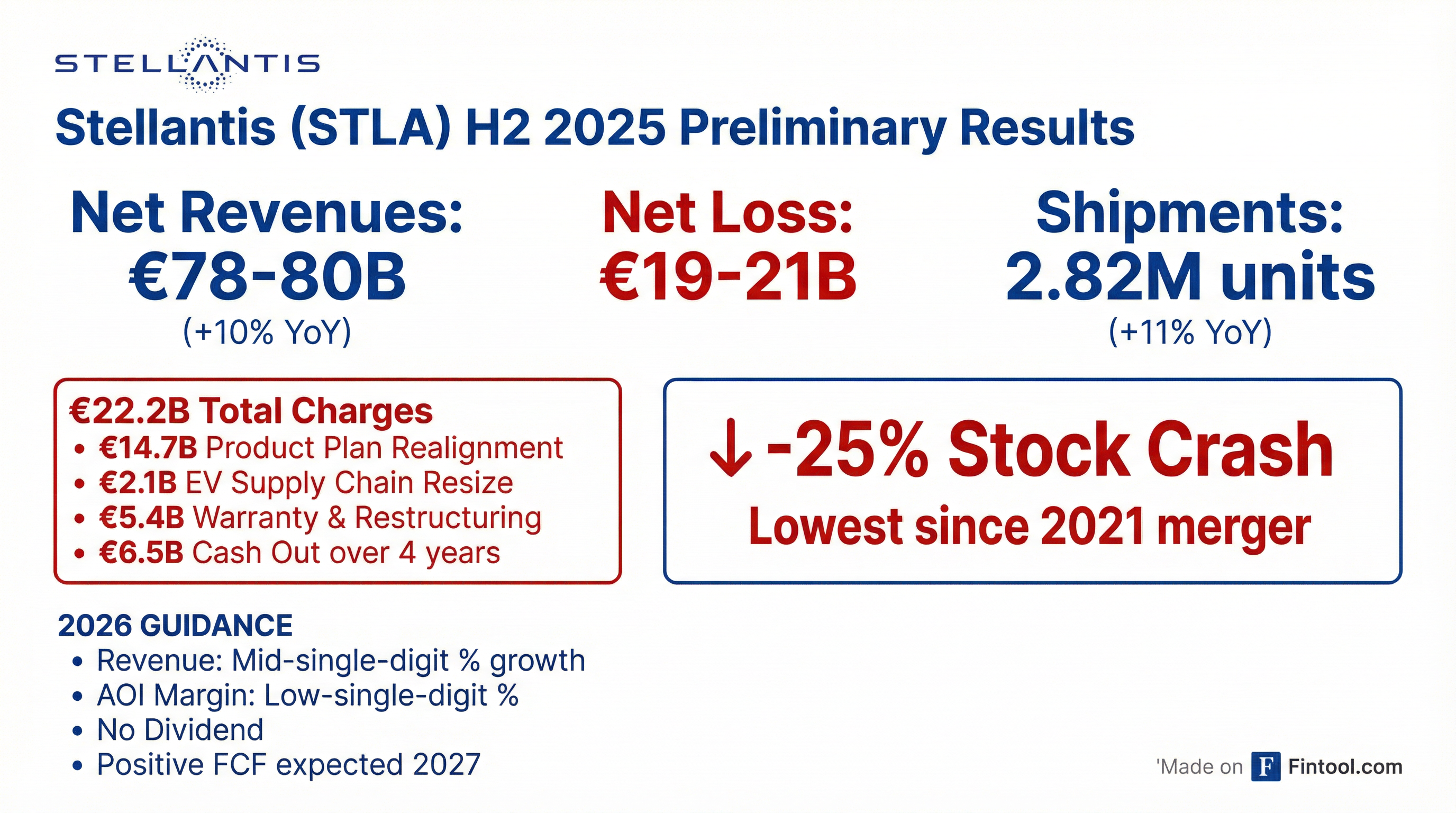

Stellantis (STLA) shares collapsed 25% to their lowest level since the 2021 merger after the automaker announced a staggering €22.2 billion ($26.5B) in H2 2025 charges tied to scaling back its electric vehicle ambitions . The company suspended its dividend, authorized €5B in hybrid bonds, and delivered a net loss of €19-21B for the period — a dramatic fall from grace for the Fiat Chrysler-Peugeot conglomerate .

CEO Antonio Filosa framed the results as a "decisive reset" to realign the business with customer preferences after years of overestimating EV demand . But with charges now exceeding the company's entire market capitalization, investors fled.

Did Stellantis Beat Earnings?

No. Stellantis reported preliminary H2 2025 results that included:

While revenue grew and shipments improved, the headline numbers were overwhelmed by €22.2B in charges that will result in a full-year 2025 net loss of approximately €19-21B .

What Are the €22.2B in Charges?

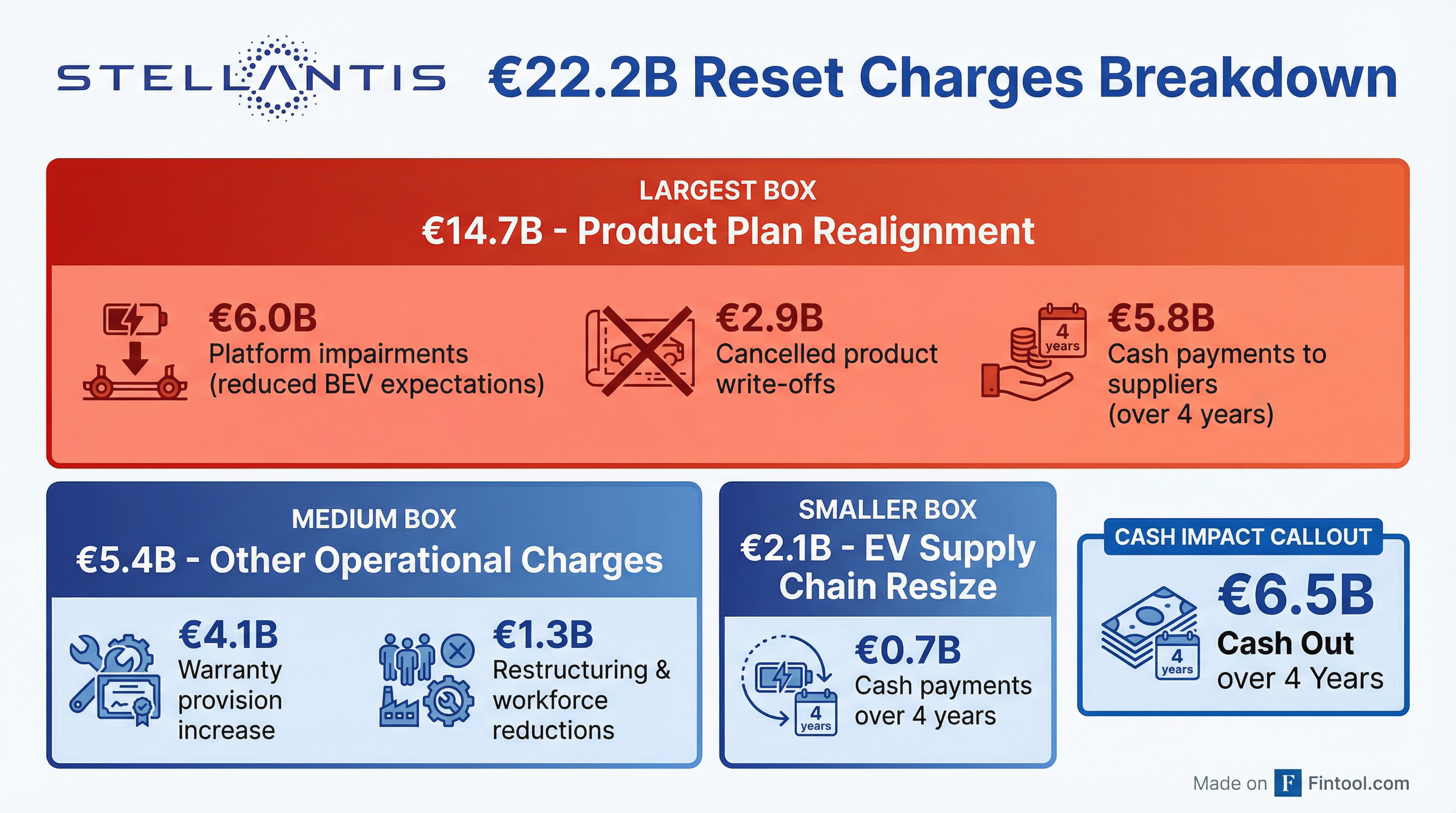

The charges represent the largest restructuring in Stellantis history and reflect a complete strategic pivot away from aggressive EV targets:

Charge Components

Cash impact: €6.5B in payments over the next four years, with €2B expected in 2026 and €1B of that in Q1 2026 alone .

CFO João Laranjo emphasized: "The vast majority of charges related to necessary corrective actions have been taken in 2025" .

How Did the Stock React?

Catastrophically. STLA shares plunged 25% to €7.50, their lowest level since the company was created through the 2021 merger of Fiat Chrysler and PSA .

The writedown now exceeds the company's entire market value — a remarkable vote of no confidence from investors .

What Did Management Guide for 2026?

Stellantis provided cautious 2026 guidance that disappointed investors hoping for a sharper turnaround:

CFO Laranjo stated the company is "not contemplating any equity raise" , but the hybrid bond authorization signals balance sheet concerns.

2026 cadence: Management expects improvement from H1 to H2 2026, with positive Industrial FCF returning in 2027 .

What Changed From Last Quarter?

Positive Signs

-

Shipments recovering: +11% YoY globally, +39% in North America

-

Order book surging: NA orders up 150% YoY; Europe orders +13% in H2, +23% in Q4

-

Quality improving: First-month-in-service issues down 50%+ in NA, 30%+ in Europe

-

New products launching: 10 all-new vehicles in 2025, including Ram 1500 HEMI V8 return, Dodge Charger SIXPACK (Car of the Year), Jeep Cherokee Hybrid

-

HEMI V8 demand: 60,000+ orders for MY2026 Ram 1500 HEMI; planning ~100,000 additional units in 2026

Negative Changes

-

Massive EV pullback: €14.7B in charges for cancelled BEV products and impaired platforms

-

Warranty crisis: €4.1B provision increase for warranty issues tied to quality problems

-

Compliance costs: €500M in European LCV emissions fines

-

Tariff headwinds: €1.6B expected impact in 2026 (up from €1.2B in 2025)

-

Dividend cut: First suspension since the 2021 merger

Key Management Quotes

CEO Antonio Filosa framed the results as a necessary reset:

"The charges announced today largely reflect the cost of overestimating the pace of the energy transition that distanced us from many car buyers' real-world needs, means and desires."

"We are today resetting our organization by empowering our regional teams so that they can accelerate decision-making process and maximize rigor of execution... Customer is back at the center of our business strategy. We drive our product plan driven by demand rather than command."

On profitability path:

"We will be profitable as a group throughout all 2026."

On the North America recovery:

"Our order book in North America is up 150% year-over-year... Our market share is growing, including in January against January last year in all channels."

Q&A Highlights

On equity raise concerns (Patrick Hummel, UBS): CFO Laranjo was direct: "We are not contemplating any equity raise" .

On European restructuring (José Asumendi, JP Morgan): CEO Filosa deflected capacity closure questions to the May 21 Investor Day, stating the focus is on "growth, not restructuring" with $13B in U.S. investments over four years .

On brand rationalization (Tom Narayan, RBC): Asked about trimming brands, Filosa praised the "iconic" portfolio (Jeep, Ram, Dodge, Fiat, Peugeot, etc.) and deferred to the Investor Day .

On tariff exposure: Key products like Jeep Cherokee (Mexico) and Dodge Charger (Canada) face tariffs, but management expects profitability through "strong mix adjustments and cost efficiencies" .

On warranty spending: CFO confirmed warranty spend will not increase in 2026 vs 2025 levels .

Regional Performance

North America is the turnaround story: the HEMI V8 return to Ram 1500 drove 60,000+ orders, and management expects ~100,000 additional HEMI units in 2026 .

What to Watch Going Forward

-

May 21, 2026 Investor Day: Brand portfolio, capacity, and strategic vision to be revealed

-

February 26 Full Results: Final H2 and FY 2025 figures with regional breakdown

-

Q1 2026 Profitability: Management committed to positive AOI at group level throughout 2026

-

Tariff Negotiations: Cherokee (Mexico) and Charger (Canada) margins at risk

-

Leapmotor Partnership: Capacity sharing with Chinese EV partner expanding in Europe and South America

Bottom Line

Stellantis delivered a brutal wake-up call for legacy automakers chasing EVs. The €22.2B charge — larger than the company's post-crash market cap — represents one of the most dramatic strategic reversals in auto industry history. While management points to recovering shipments, surging orders, and improving quality as green shoots, the stock's 25% collapse signals investors are not yet convinced the reset will restore value.

The suspension of dividends, authorization of hybrid bonds, and admission that positive free cash flow won't return until 2027 all weigh heavily. CEO Filosa's Investor Day on May 21 will be critical to restoring credibility.

Data sourced from Stellantis H2 2025 earnings call transcript , company press releases, and S&P Global.